Charles Darwin once said:

“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.”

This principle also applies to the financial markets. As they evolve, so must our ability to adjust our trading approach. This article will explore the importance of adapting your trading strategy to different market conditions and discuss how to successfully align your approach with market complexities.

Understanding the 3 Types of Market Conditions

To effectively adapt, it is crucial first to understand the different types of market conditions and their implications – here is why:

- Adaptability — market conditions aren’t static. Understanding the current market environment enables traders to adjust their strategies accordingly. Being adaptable allows you to capitalize on opportunities presented by favorable market conditions and adjust your approach to mitigate risks during challenging times.

- Limiting losses — market conditions affect the behavior of the masses, thus the performance of different financial instruments and the overall direction of prices. Understanding the prevailing market conditions helps you identify potential risks and adjust your trading strategy to minimize losses. For example, in highly volatile markets, you might consider implementing tighter stop-loss orders and reducing position sizes to protect your capital.

- Maximizing your profits — market conditions provide valuable insights into timing and opportunity. For instance, in trending markets, traders can identify the direction of the trend and ride the momentum, maximizing the profit potential.

- Higher chance of achieving trading goals — different market conditions require different approaches. Aligning your strategy to the prevailing market conditions can help increase your chances of making profitable trades and reaching your goals.

Having discussed the importance of understanding market conditions, it is now time to delve into the three types:

1. Trending Markets

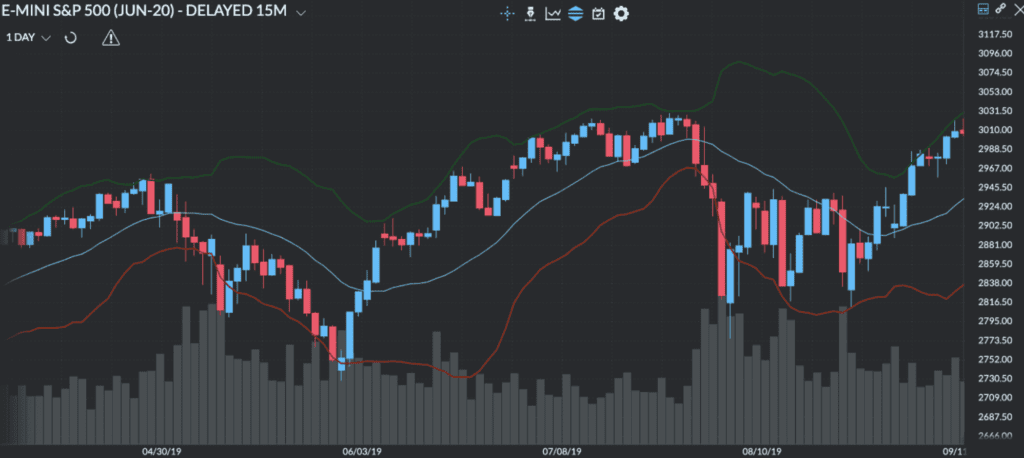

Trending markets are characterized by a sustained and consistent movement in a particular direction. There are two types of trending markets.

The first is the uptrend, where prices consistently rise, indicating bullish sentiment. This presents opportunities for traders to enter long positions, anticipating further price appreciation.

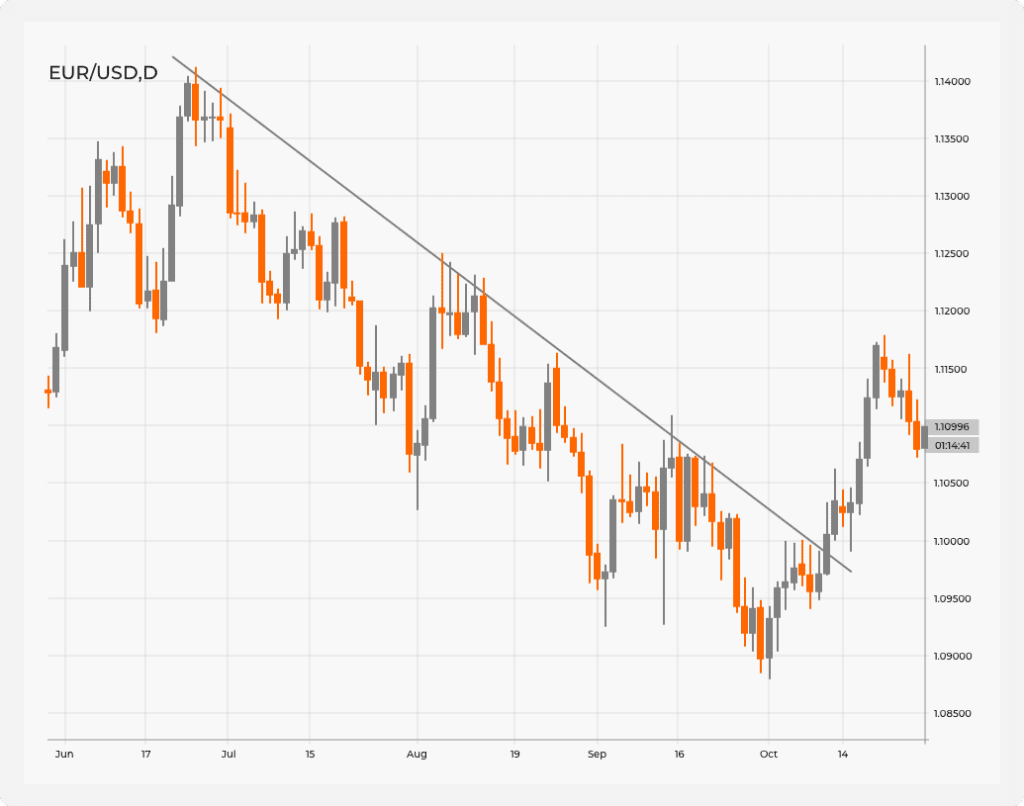

Conversely, in a downtrend, prices consistently fall, reflecting market participants’ bearish sentiment. Traders can take advantage of short-selling or other bearish strategies.

Recognizing and understanding trending markets is essential because they offer significant profit potential. By following the trend, you align yourself with the prevailing market sentiment and increase the probability of successful trades.

Trending markets tend to exhibit momentum, meaning prices will likely continue moving in the same direction for a certain period. This momentum can lead to sustained profits for traders who effectively ride the trend.

2. Ranging Markets

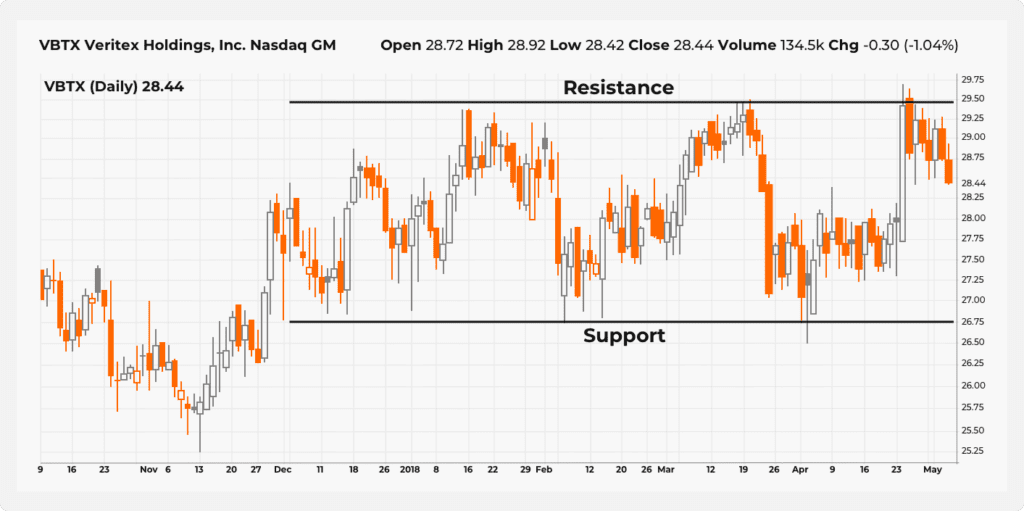

Also known as sideways or consolidating markets, ranging markets are a type of market condition where the prices of financial instruments move within a relatively narrow range. Unlike trending markets, where prices exhibit a clear upward or downward trajectory, ranging markets lack a sustained direction.

In a ranging market, prices fluctuate between established support and resistance levels. You can identify these levels by analyzing historical data and observing areas where prices have repeatedly stalled or bounced back.

During ranging markets, you can capitalize on price oscillations within the established range — buying at or near support levels and selling at or near resistance levels. Taking advantage of these price fluctuations can help you benefit from repeated movements between support and resistance.

However, because there is no clear trend or momentum in a ranging market, you’ll always need to be on the lookout for breakouts so you don’t get stuck in a losing position.

3. High-Volatility Markets

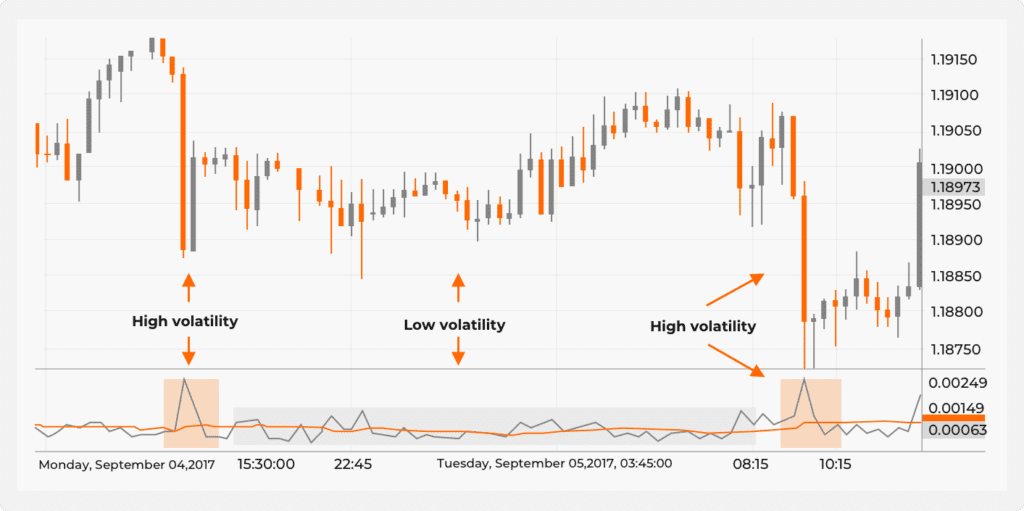

Significant price fluctuations and increased uncertainty characterize this market condition. In high-volatility markets, prices experience sharp and rapid movements, often accompanied by increased trading activity.

Various factors, including economic news releases, geopolitical events, market sentiment shifts, or sudden changes in supply and demand dynamics, can drive high-volatility markets. These events can trigger a surge in market activity, leading to sudden large price swings within short periods.

Prices can surge or plummet quickly, so it‘s essential to be able to react swiftly to capitalize on opportunities or protect against potential losses. Short-term trading strategies, such as scalping or day trading, are typically ideal for high-volatility markets because they let you take advantage of short-lived price fluctuations.

While high-volatility markets offer the potential for substantial profits, they also come with increased risks. Trade these markets cautiously.

Factors Affecting Market Conditions

To successfully adapt your trading strategy, you should be aware of the most important factors that can cause markets to change. Here are some of them:

Economic Data Releases

Economic indicators such as GDP growth, employment figures, inflation rates, and central bank decisions can profoundly impact market sentiment. Positive financial data signals can stimulate buying interest and drive prices higher, while negative releases can lead to sell-offs and price declines.

News Events

News events, particularly those related to geopolitical developments, corporate earnings, or significant policy changes, can cause market disruptions. This can lead to volatility and uncertainty, leading to rapid price movements and a shift in trading dynamics.

Herd Behavior

Herd behavior refers to market participants’ tendency to follow the majority’s actions and decisions. When traders observe others making certain trades or adopting specific strategies, they may feel compelled to do the same, leading to herd behavior. This behavior can amplify market movements and create trends or bubbles.

Central Bank Policies

Monetary policies implemented by central banks have a profound influence on market conditions. Decisions regarding interest rates, quantitative easing, or other policy tools can impact investor sentiment and drive market movements.

Market Sentiment

Market sentiment, often driven by emotions and perceptions, can significantly influence trading conditions. For example, optimism or pessimism among market participants can lead to buying or selling pressure, respectively.

How to Adapt Your Trading Strategy to Different Market Conditions

Adapting your trading strategy to different market conditions is essential for achieving consistent success. Here are some tips to consider:

Use the Right Technical Analysis Tools

Technical analysis tools can provide valuable insights into market trends, volatility, volume, and potential price reversals. Being able to adapt your strategy means knowing the right tools to utilize for different market conditions.

In Trending Markets:

Trend-following indicators like the Moving Average Convergence Divergence (MACD) can help you identify the momentum and strength of a trend.

Another popular indicator for trending markets is the Bollinger Bands. They can provide insights into the volatility and price levels relative to the trend.

In Ranging Markets:

Indicators like horizontal trendlines, Fibonacci arcs, and pivot points are great for determining support and resistance levels. From there, you can identify the ideal entry and exit points and adjust your trading strategy accordingly.

Additionally, oscillators such as the Relative Strength Index (RSI) or Stochastic Oscillator can be useful in ranging markets. These indicators help identify overbought and oversold conditions, signaling potential reversals when the price reaches extreme levels.

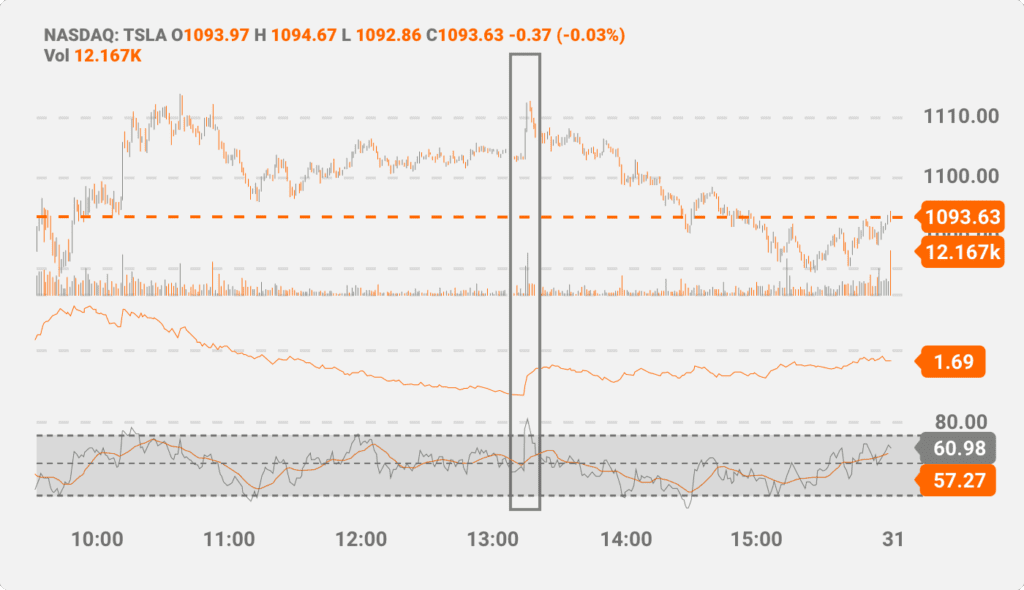

In High-Volatility Markets:

Volatility indicators, such as the Average True Range (ATR), can provide insights into the magnitude of price swings. Traders can adjust their strategies and position sizes based on the level of volatility indicated by the ATR.

The chart below shows a spike in the ATR and RSI values (inside the box). The two indicators generate a sell signal.

Engulfing patterns, Doji candles, or harami patterns can also help identify potential price reversals or continuations in a high-volatility market.

Remember, no single indicator guarantees profitable trades if used on its own. Consider combining different indicators and tools that complement each other to comprehensively understand the market conditions.

Focus on Fundamental Analysis

Fundamental analysis involves diving into economic data, company earnings reports, industry trends, and market news to evaluate the underlying value of an asset. This process also extends to monitoring news and developments that can impact market sentiment.

By staying informed and conducting thorough research, you can gain valuable insights into the underlying factors that drive market movements. This information allows you to adapt your trading strategies and confidently navigate the markets.

Enforcing Proper Risk Management Strategies

Effective risk management revolves around several fundamental principles, including imposing self-discipline, avoiding overtrading, implementing stop-losses and take-profits, and adjusting trade size based on the overarching market conditions.

These principles all contribute to mitigating risk and fostering a sustainable trading approach. The primary goal here is to prioritize capital preservation and long-term profitability. Traders who effectively manage risk are better positioned to navigate various market conditions and achieve their trading goals in a consistent and controlled manner.

Monitor Big Money Movements

In essence, it’s important to ‘follow the money.’ Institutional investors often have access to substantial resources, and their market moves can often create ripples affecting market sentiment.

Identifying and understanding the moves of the whales can help you make informed decisions about your current trading strategy.

Conclusion

Adaptability is a fundamental skill that sets successful traders apart. To successfully adapt your trading strategy to different market conditions, you need to understand market changes, use the right technical analysis tools, stay informed through fundamental analysis, and implement proper risk management strategies.

All this will enable you to navigate changing market dynamics, protect capital, and increase the chances of achieving your trading goals.