Pip, pipette and lot are words you’ll often come across in any conversation about forex trading. Understanding this concept and knowing how to calculate it is crucial to trading. That’s because it covers exchange rate movements, profit or loss calculations on a position, and effective risk management. However, many traders are still vaguely familiar with pips, which puts a large burden on their trading performance. In light of this, we’ve put together this guide on what they are, how to calculate their value and examples of how they are used in trading.

What is a Pip?

It’s an abbreviation for “Percentage In Point” in Forex trading, though it is also called “Price Interest Point” in some circles. In any case, a pip refers to the smallest price movement in a currency pair for a given exchange rate.

They are used to reference gains or losses on a trade. Understanding their changes in value can help traders better manage their trading strategy.

You may also like:

Measuring it

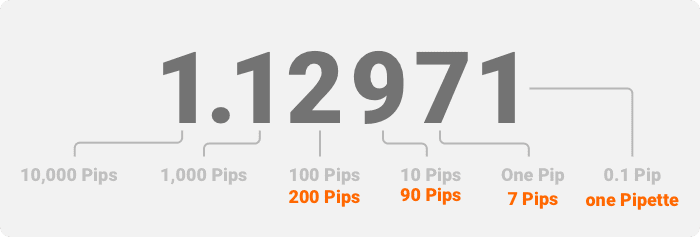

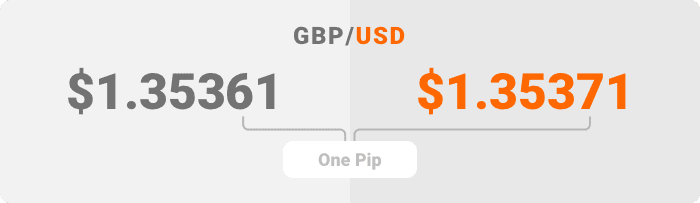

Most often they’re measured using the fourth decimal point. So let’s say the price of a currency pair moves by 0.0001, then the price has moved 1 pip. If it moves by 0.0005, the price has moved 5 pips. Of course, this is only a simplistic illustration as there are currencies like the Japanese Yen that are expressed in only two or three decimal places, depending on the trading platform.

That being said, most major currency pairs are actually priced to 4 decimal places, hence the measurements tend to be based on this format. The last decimal point represents one basis point. So if for instance, a trader makes 50 pips on a trade, it means he or she profited by 50 pips. The actual amount of this profit then depends on the pip value.

What is pip value?

In any given trading position, pip value refers to the change in value following a one-pip movement in the relevant foreign exchange rate. It’s essentially the price attributed to a one-pip move in a trade and used to reference the gains or losses incurred on a position.

The currency pair being traded, the size of the trade, and the exchange rate at the time of trading all influence the pip value of the position.

How to calculate pips

Usually, you will not have to calculate pip values yourself, as most forex brokers or platforms will do it for you. There are also several calculators available so you don’t have to exert brain power in trying to determine decimal points and percentages. Still, calculating them is a useful skill to familiarise yourself with, so here goes:

To calculate the value, take one pip (0.0001) and multiply it by the trade size or number of base units being traded (lot), then divide the figure by the current market value of the currency pair.

Pip Value = (Decimal Place Pip x Trade Size) / Exchange Rate

This means that pip values will differ between currency pairs since there will always be variations in exchange rates. If the quote currency is the US dollar, however, the value remains the same — a standard lot size of 100,000 equals a pip value of $10 (0.0001 x 100,000).

Example: Suppose you’re trading the U.S. Dollar/Canadian Dollar pair (USD/CAD) in a USD account, then simply divide the value for a standard lot ($10) by the USD/CAD rate. Let’s say the USD/CAD rate is 1.3000, then the pip value amounts to USD$7.69 ($10/1.30).

What if I’m using a non-USD account?

The thing to note here is that pip values are typically fixed when the currency the account is funded with is listed as the second in a pair. For example, if you have a British Pound (GBP) account, any pair that is GBP/XXX, such as the GBP/USD will have a fixed pip value.

To calculate the value for a GBP/XXX pair, divide the fixed pip rate by the exchange rate. For example, if the British Pound/Swiss Franc pair has an exchange rate of 0.8550, then a pip is worth GBP 11.70 for a standard lot (£10/0.8550).

If your trade includes the Japanese Yen (GBP/JPY), for instance, the formula is slightly different since pip movements for the Yen are measured in two decimals. In this example, after calculating the pip value, multiply your result by 100.

For example, if the GBP/JPY exchange rate is at 134.70, divide £10 by 134.70, then multiply the result by 100, for a pip value of £7.42.

Calculating Position Size

Position sizing simply refers to setting the appropriate amount of units of a currency pair to buy or sell within your risk comfort level. It’s also referred to as the lot size. Here’s how to go about it:

- Decide on your risk per trade – This is the total risk you’re willing to be exposed to on a single trade. This is usually expressed as a percentage of the balance in your trading account. The general rule of thumb is to not risk above 2% of your account balance on a trade. So let’s say your account balance is $100,000, your risk exposure should typically not exceed $2,000 per trade.

- Determine your Stop Loss in Pips – A Stop Loss is essentially an exit plan for when the market swings against you so you don’t incur more losses. Before entering the trade, place your Stop Loss level expressed in pips. For instance, if you’re trading the EUR/USD pair at a potential entry price of 1.2080 and you place your Stop Loss at 1.2030, then you have a Stop Loss of 50 pips.

- Calculate your position size – The simplest way to do this is to divide your risk per trade by your stop loss times pip value.Position Size = (Capital x Risk Percentage Per Trade) / (Stop Loss x Pip Value)Using the figures above, our position size will then be ($100,000 X 2%) / (50 X $10) = (2,000)/(500) = 4.

Therefore, the position size or lot size is 4.Sidenote: you’ll notice that the pip value for EUR/USD is $10, which is the same as $10/1.2080 = €8.2781.

Calculating Pip Movements On The Chart

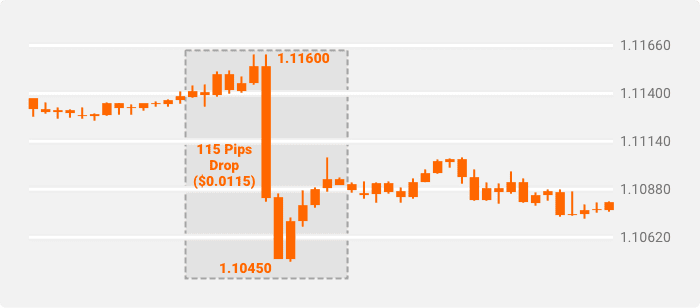

The process for calculating pip movements is pretty straightforward — identify the price move on the chart, marking both the beginning and end prices of the move. Next, subtract the beginning move price from the end move price.

Consider the chart below:

As you can see, there was a steep price drop from 1.1160 to 1.1045 before the price began going up again (next green candle). Now that we’ve identified the start and end of the price movement, we simply subtract.

1.1045 – 1.1160 = – 0.0115

This represents a 0.0115 loss on the trade, which can be expressed as 115 pips.

What is the Difference Between Pips, Pipettes, and Lots?

You already know that a pip is a unit of measurement representing the change in value between traded currency pairs and that pips are usually measured using the last (fourth) decimal point of a quotation. But what if you come across a quotation with five decimal places? That’s where pipettes come in.

What is a pipette?

In simplest terms, a pipette is a fractional representation, usually 1/10, of a pip. Sometimes brokers can quote currency pairs beyond the standard 4 and 2 decimal places and you can end up with 5 and 3 decimal places instead. So the pipette represents the fifth decimal point in most currencies, or the third, in the case of Japanese Yen pairings.

For example, if the GBP/USD pair experiences a move from 1.40510 to 1.40511, the 0.00001 increase is one pipette.

What is a lot?

A lot refers to the number of currency units you wish to trade. These numbers are typically fixed so if you want to enter a trade, you can only buy that number of units per trade. Thankfully, Lots come in different sizes, depending on your risk appetite and liquidity.

Lot

- Nano

- Micro

- Mini

- Standard

Number of Units

- 100

- 1,000

- 10,000

- 100,000

Source: fxtacademy.com

As mentioned above, a standard lot equals 100,000 units of a base currency. You also cannot go above or below the specified number — you can’t opt for a standard lot and then say you only want to purchase 70,000 units. Instead, you can purchase seven mini lots at 10,000 units each.

Examples of Pips in Trading

Learning about their relevance in forex trading is best done through examples, so let’s look at a few:

Example 1

Suppose you traded two standard lots on the EUR/USD pair and it closed at 1.1750 after gaining 60 pips. What would be your total profit from the trade?

Recall that Pip Value = (Decimal Place Pip x Trade Size) / Exchange Rate

Pip value = (0.0001 x 2 x 100,000) / 1.1750 = €17.02

Or in USD, that’s $20 = €17.02 / 1.1750

To determine our profit, multiply the pip value by the pip movements:

€17.02 x 60 pips = €1021.2 in profit, or expressed again in USD that’s $20 x 60 pips = $1,200

Example 2

Let’s look at a loss calculation. If you traded one lot on the USD/JPY pair and it closed at 110.40 with a loss of 50 pips. What would be the total loss from the trade?

Since we’re trading the Yen, we use only 2 decimal places:

Pip value = (0.01 x 100,000) / 110.40 = $9.05

That’s $9.05 x 50 pips = ($452.50) in losses.

Conclusion

Having a thorough understanding of pips and pipettes will go a long way in helping you become a better Forex trader. Remember to get as much practice as possible on a virtual account before taking it live.