The Gauntlet Mini™

Your shortest path to become a funded trader

Become a funded futures trader with Earn2Trade's trader funding test. Show your skills on a virtual account to get a funding offer from a proprietary trading firm that upgrades when you withdraw your profit.

Choose your account size

Start your evaluation on a virtual futures trading account ranging from $50,000 to $200,000.

Trade at least 10 days

Prove your skills over a period of at least 10 trading days.

Get a funded trading account

Pursue the career you’ve always wanted with a funded trading account.

How the Gauntlet Mini™ Works

Our funded trader program

The Gauntlet Mini™ is an intraday futures trading exam that guarantees trader funding by our proprietary trading firm partner upon successful completion. To pass the test, you must trade without breaking the rules for at least 10 days and reach the specified profit target. It is a subscription-based examination that lasts until you pass, cancel, or change your plan.

Show your skills to get an offer

Trader Funding

There’s a limit to how much money you can make on a personal trading account. The Gauntlet Mini™ helps traders who have the skill but lack the capital to overcome this obstacle by providing them with access to funds in return for a share of the generated profits. Take the test on a simulated account and qualify for funding based on the chosen size of your evaluation account.

The Gauntlet Mini™ Evaluation

Pass the test and get a guaranteed funding offer from our partner.

The Gauntlet Mini™

Objectives

- Trade at least 10 days

- Only trade during approved times

- Follow the progression ladder

- Do not reach or dip below the daily loss

- Do not reach or dip below the minimum account balance (EOD Drawdown)

Funded Trader Reviews

Check out these reviews and testimonials from users who passed our test and received their funding offer. They did it, and you can too! Be one of the thousands of traders who become funded futures traders through Earn2Trade's funded trading program.

Client testimonials displayed on this website originate from verified Trustpilot users. Please note that these testimonials do not constitute a guarantee of future performance or outcomes.

The Gauntlet Mini™ FAQ

Traders who specify their CME status as “professional” will be charged $135.00/month per exchange.

There is no fixed end date for the evaluation. The Gauntlet Mini™ will continue until the candidate successfully meets the targets, or cancels their subscription. Please note that the monthly subscription does not reset the account. If you failed your Gauntlet Mini™ attempt, you have to reset.

Reset prices depend on your selected evaluation account size:

- GAU50 ($50K) – Dynamic pricing (adjusts monthly based on active promotions; always below the current price of a new subscription)

- GAU100 ($100K) – Fixed rate of $100

- GAU150 ($150K) – Fixed rate of $130

- GAU200 ($200K) – Fixed rate of $155.00

Please Note:

- Subscription renewal does not reset a failed evaluation and does not include a free reset.

- Resets are only available during the evaluation period. Once funded, your Live or LiveSim® account cannot be reset.

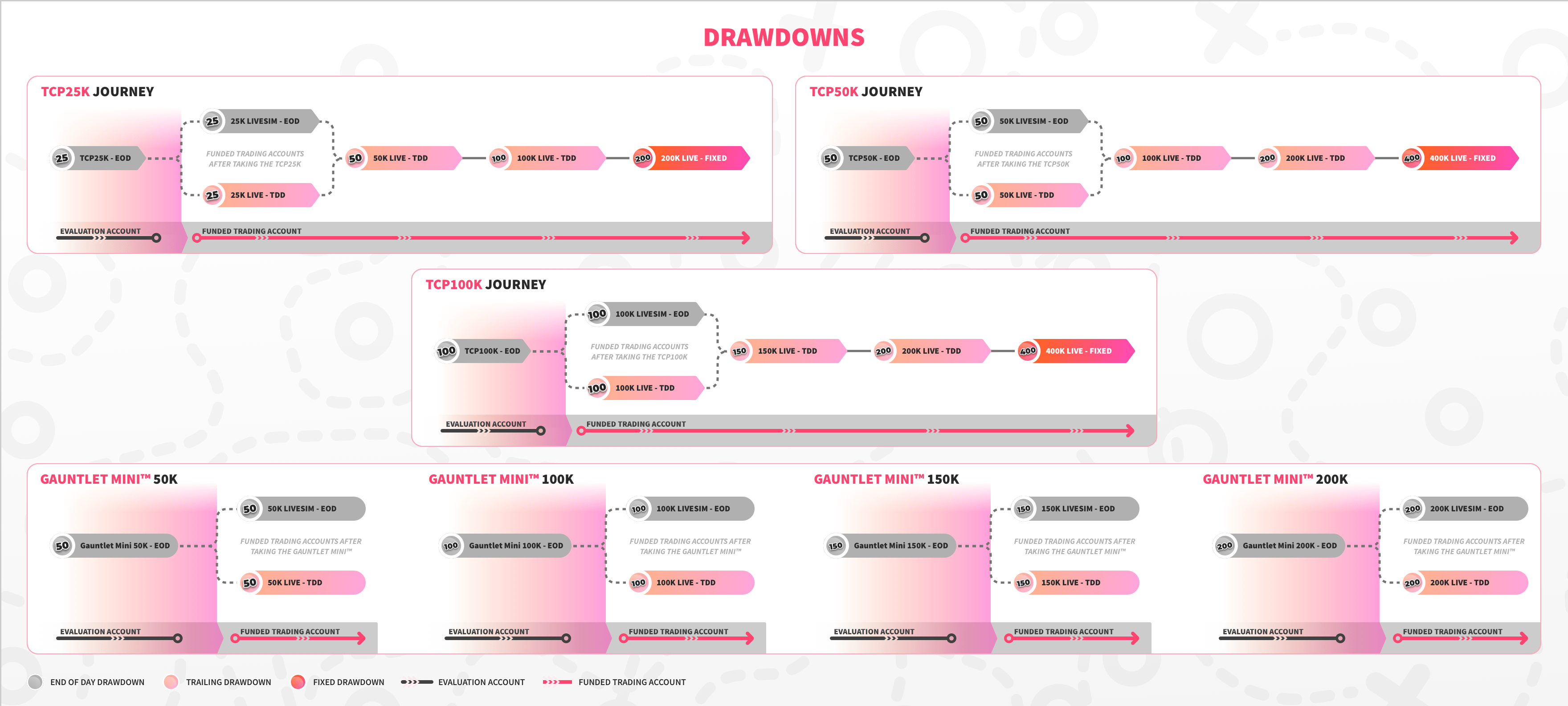

- LiveSim® Accounts

- Live Accounts

LiveSim® Accounts

LiveSim® accounts are paper trading accounts. From the trader’s perspective, they function the same as Live accounts, including withdrawing profits, but with a few added benefits:

- LiveSim® has a quicker setup. Traders can start trading them within two business days of accepting the funding agreement.

- LiveSim® traders with Non-professional CME status will have a one-time per-account activation fee of $139.00 deducted from their first withdrawal amount, covering all four CME exchanges, and the costs associated with setting up and maintaining a funded account. This fee only gets deducted if they make profits and it is exclusively applicable to their first withdrawal and not to subsequent ones.Those with Professional status will be charged $135.00/month/exchange.

- LiveSim® accounts calculate drawdown the same way as your Gauntlet Mini™ attempt. See the relevant FAQ explaining the drawdown calculation here.

Live Accounts

Traders who choose to start trading on a Live account cannot return to a LiveSim® account afterward.

- Live accounts take longer to set up because they require filing paperwork with a broker.

- Monthly data fees on Live accounts are $135.00 for each exchange, including the first.

- Live accounts calculate trailing drawdown based on intraday, open equity gains and losses.

The withdrawals have a cost of $10 per payment/ withdrawal, however the proprietary trading firms will waive this charge in its entirety for withdrawals above $500.

Withdrawals are processed through Rise, a third-party contract- and payment provider service.

Read more about the withdrawal policies here.

For more information please see: help.earn2trade.com

Get A Funded Trading Account

- The Gauntlet Mini™ Trader Funding Evaluation

- Free NinjaTrader and/or Finamark license

- Trading Simulator (Data Feed Included)

- Free Journalytix™ license

- Access to Our Full Catalog of Educational Material During Your Subscription

- Guaranteed Funding Offer After Successful Completion

Earn2Trade LLC

30 N Gould St STE 4000, Sheridan, WY 82801

In 2024, 10.42% of candidates passed the Trader Career Path® / Gauntlet Mini™ examinations. Percentage is based on subscriptions passed against new subscriptions. Of candidates who passed either exam or progressed in the Trader Career Path®, 10.04% traded a Live account, and 89.96% traded a LiveSim® account. The Trader Career Path® / Gauntlet Mini™ examinations are realistic simulations of trading in actual market conditions and are difficult for any experienced trader to pass. Neither the Trader Career Path® nor Gauntlet Mini™ examinations are suggested for individuals with little trading experience.

Earn2Trade exam participants are permitted to trade Futures products only, listed on the following exchanges: CME, COMEX, NYMEX & CBOT. Trading of Stocks, Options, Forex, Cryptocurrency and CFD’s are not permitted nor available in our program or platforms.

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Day-Trading Risk Disclosure Statement

Join Our Trader Community

Join Our Trader Community